The government’s two approaches to inflation relief

Speaking Security Newsletter | Note n°177 | 27 October 2022

If you find these notes useful, you can support this newsletter and SPRI, here.

1. Government inflation policy for military contractors: More cash

Pentagon contracts are already very industry-friendly, but that hasn’t stopped the arms industry from demanding more cash to offset inflation’s impact on company profits.

One recent episode: The Aerospace Industries Association sent a letter to Senate Armed Services leadership on September 28 urging them “to include bill language in this year’s NDAA granting the Department of Defense (DOD) the authority to modify existing DOD contracts” because of “record levels of inflation.”

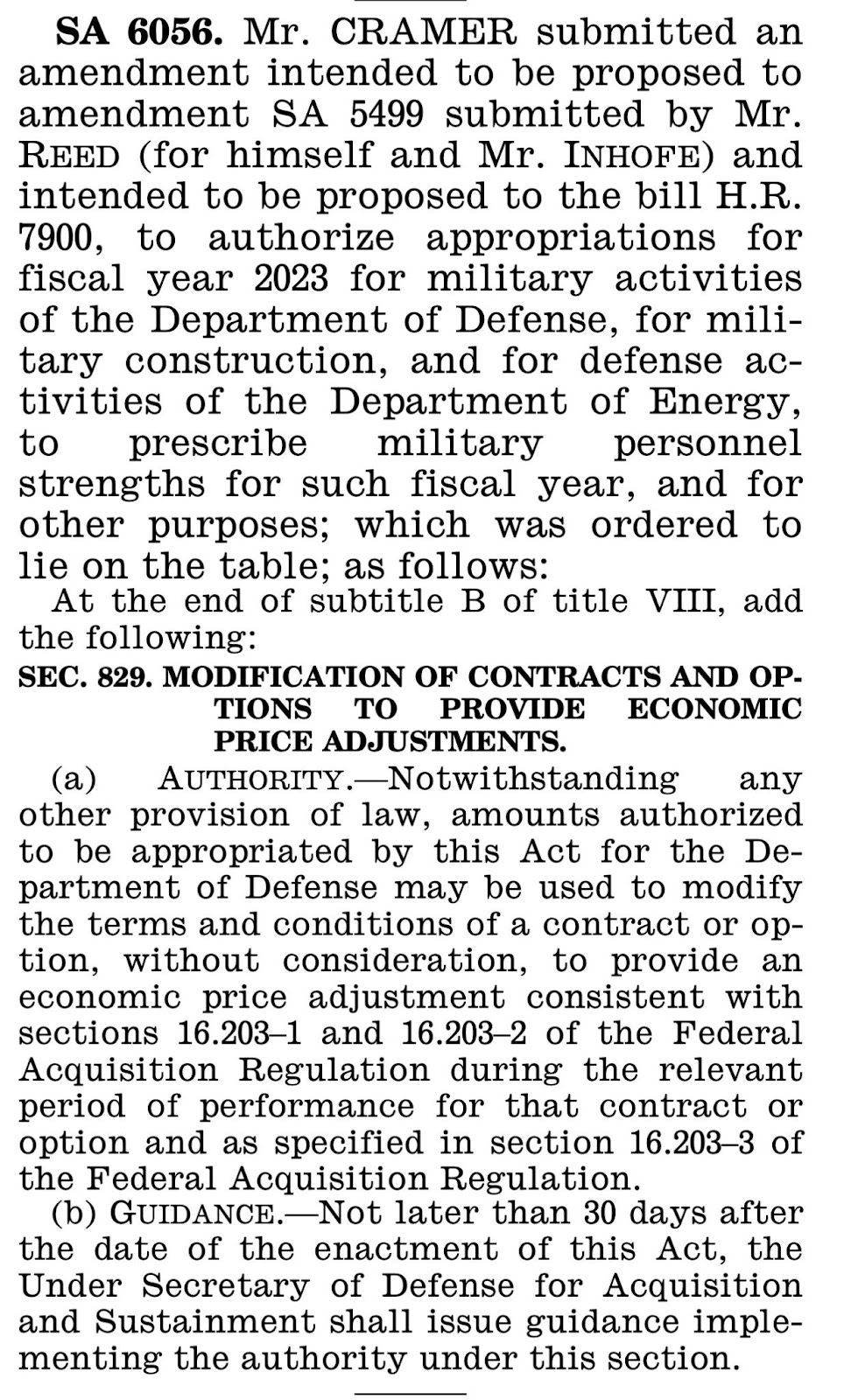

One day later, Senator Kevin Cramer (R, ND) introduced an amendment* doing exactly that, later citing “record–high inflation” as the principal justification. Mirroring the AIA’s request, Cramer’s amendment would allow funds authorized by the pending FY2023 NDAA (military policy bill) to be used “to modify the terms and conditions of a contract” in order to “provide an economic price adjustment” for military contractors.

^Cramer’s amendment (Source)

The Senate’s draft bill of the NDAA—which will be voted on after midterms—contains an historic amount of cash for the arms industry. The legislation would authorize an $858 billion Pentagon budget for FY2023—keeping in mind that more than half of the Pentagon budget goes to private sector contractors—amounting to a $76 billion increase over FY2022 levels (excluding supplemental military funding for Ukraine). Following industry’s lead, inflation is the first reason Cramer listed in a press release explaining why he supported this massive spending surge: “The increase will begin to fill the gaps created by Biden’s inflation,” he said.

There was zero objection from Biden on Cramer's amendment or the topline budget number in his Statement of Administration Policy on the Senate bill. (This is why corporate media’s typical characterization of congressional increases to Biden’s budget as an act of defiance toward the administration—see here, here, here, and here, to name just a few—is farcical. There’s simply no conflict to speak of; Biden is fine with these increases. He’s literally supported them every single time.)

*Recommended reading: Julia Gledhill’s article—out today—which provides a lot more insight into Sen. Cramer’s amendment and its political context than what I’ve got above. Check it out here.

2. Government inflation policy for workers: No cash

Inflation is dealt with much differently outside the military-industrial complex. Democrats quickly reneged on their promise of $2,000 relief checks after the 2020 elections—shorting us $600—then the White House threw cold water on the idea of a fourth stimulus payment, citing the cost.

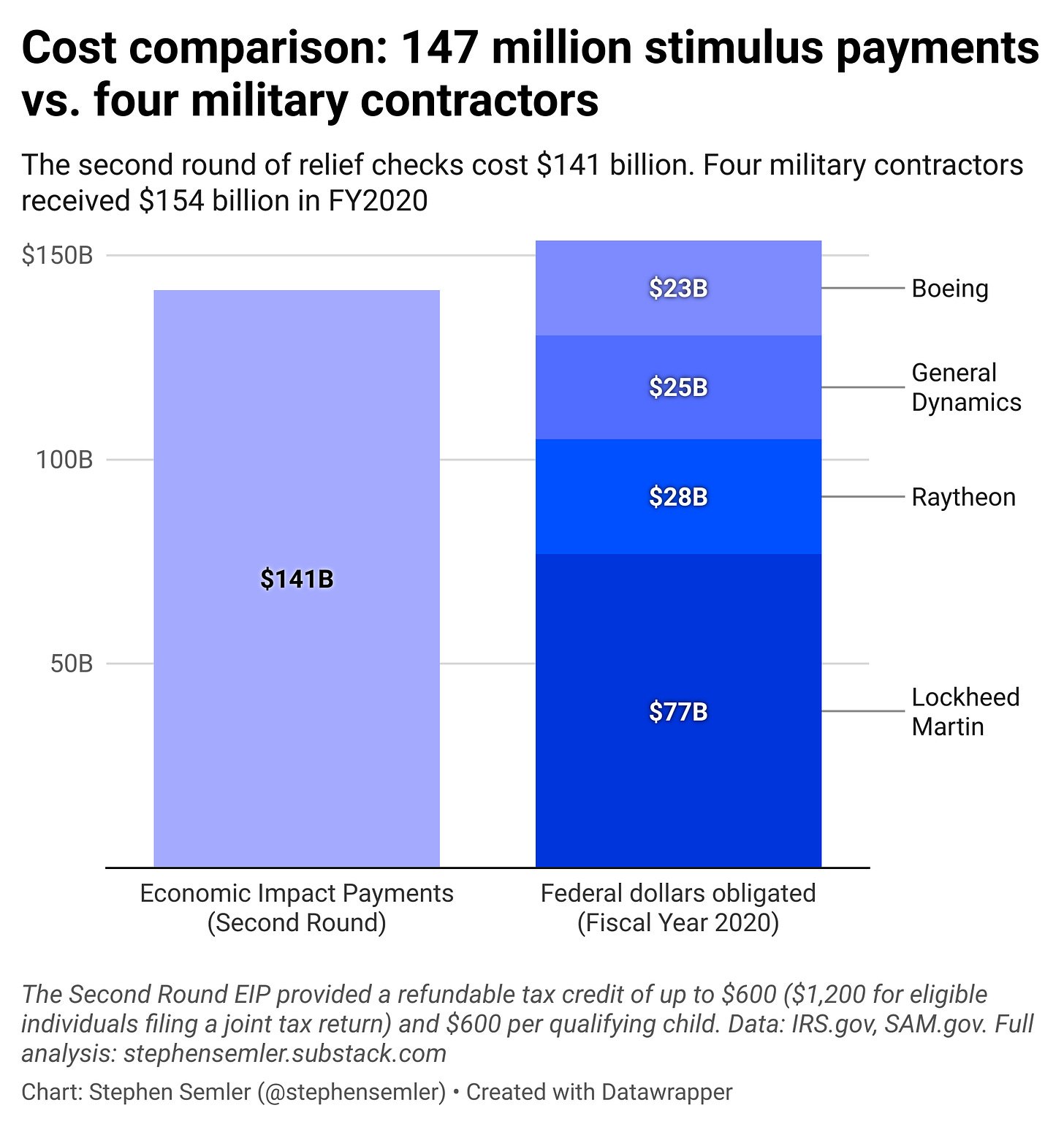

Another round of $600 checks would be particularly helpful for folks now (not to mention for the electoral prospects of Democratic candidates). The cost? About $13 billion less than the amount that went to just four military contractors in FY2020:

^Alt text for screen readers: Cost comparison: 147 million stimulus payments versus four military contractors. The second round of relief checks cost $141 billion. Four military contractors received $154 billion in fiscal year 2020. This chart has two columns. The one on the left displays the $141 billion cost of the second round economic impact payments. The column on the right has the amount four companies received in fiscal year 2020 in federal contractors. Lockheed Martin, $77 billion; Raytheon, $28 billion; General Dynamics, $25 billion; Boeing, $23 billion. The Second Round payments provided a refundable tax credit of up to $600 and $1,200 for eligible individuals filing a joint tax return and $600 per qualifying child. Data: IRS, SAM. Full analysis at stephensemler.substack.com.

-Stephen (@stephensemler; stephen@securityreform.org)

Find this note useful? Please consider becoming a supporter of SPRI. Unlike establishment think tanks, we rely exclusively on small donations.