If you find these notes useful, you can support this newsletter and SPRI, here.

Situation

Joe Biden signed the Inflation Reduction Act (IRA) into law on August 16. The bill makes $437 billion worth of investments across a 10-year period.

Democrats are selling the IRA as a major victory, but the reconciliation bill is a far cry from the $2.2 trillion version the House passed in November (this bill—the Build Back Better Act—was itself a slimmed-down version of the $3.5 trillion spending framework endorsed by House and Senate Democrats last August). What’s more, the IRA includes several giveaways for the fossil fuel industry and doesn’t undo Trump’s 2017 tax cuts.

Defending the IRA

The IRA has one-sixth the funding as the House-passed reconciliation bill and includes a bunch of corporate sweeteners. Disclosing this fact on Twitter or in Whole Foods typically results in people telling you to shut up and be grateful because that’s all that’s possible in the current political climate: Democrats have the majority in the Senate, sure, but Manchin and Sinema are fiscal conservatives—they wouldn’t have gone for anything bigger.

That reasoning is based on two assumptions, both of them wrong. First, like many lawmakers, Sinema and Manchin are only selectively fiscally conservative. They support big bills all the time. For example, each voted for every single military budget since entering office.

Second, Manchin and Sinema’s votes can be bought. Both are very responsive to measures that benefit their corporate sponsors or cater specifically to their constituents. For its part, the IRA includes provisions that enrich Manchin’s donors and fund projects in West Virginia. The bill is tailored for Sinema’s donors, too, and has a $4 billion amendment for “Western Drought Resiliency” at the request of a group of senators led by Sinema.

The infrastructure bill was supposed to be the bribe

These specifically-tailored provisions (bribes) would have to be scaled up for a larger piece of legislation like the $2.2 trillion House-passed reconciliation bill. But there was already a legislative vehicle arranged to deliver those bigger bribes. It was the infrastructure bill.

Originally a $2.7 trillion plan, Biden cut down his infrastructure bill by 80% during negotiations with Republicans. The legislation started out with both human and physical infrastructure programs but only ended up with the latter. The reconciliation bill was supposed to be the catchall for the stuff that was stripped out.

To ensure the reconciliation bill wouldn’t also be hollowed out, Democrats promised to pass them simultaneously. This would deter conservative Democrats from gutting the reconciliation bill’s universal social programs after getting the highway and pipeline funding they wanted from the infrastructure bill.

David Sirota skillfully explained this arrangement in an article published this time last year:

Right now, there are two bills — a somewhat limited bipartisan infrastructure bill and a much more ambitious budget proposal that includes anti-poverty and climate initiatives. The interplay between the bipartisan infrastructure bill and the much larger anti-poverty/climate bill is essential, because American politics is so wildly corrupt that in order to get the bare minimum of good things, you typically have to lard it up with lots of stuff that’s not so good.

Put simply: In order to have any chance of passing a budget bill with huge investments in clean energy, our kleptocratic politics requires a corruption tithe — in this case, funding for roads and airports and all sorts of other carbon pollution that big donors want, but that might not be advisable in the era of cataclysmic climate change.

At this point, powerful industry groups have stripped down the infrastructure legislation so that it includes all the corporate goodies they want and almost none of the initiatives needed to avert an ecological disaster. These business interests purchase politicians through campaign cash, and they have now ordered them to pass this legislation and kill the separate budget bill that may end up including the stuff corporate interests hate — stuff like polluter taxes and fairer corporate taxes, an end to oil subsidies and provisions that would let Medicare negotiate lower prescription drug prices.

The Progressive Caucus folds

Initially, most Democrats said they were on board with this plan. Biden said he’d veto the infrastructure bill if it wasn’t accompanied by the reconciliation bill, and Speaker Pelosi said “there ain’t no infrastructure bill without the reconciliation bill.”

The Congressional Progressive Caucus advocated for the same ‘hold the line’ strategy. The caucus committed to voting down the infrastructure bill until the Senate passed the reconciliation bill. Here is the Chair of the Progressive Caucus after the Senate passed the infrastructure bill:

The Progressive Caucus matters in this story because Biden and Pelosi reneged and began insisting that the bills be passed one at a time. For a moment, the Progressive Caucus resisted, holding on to their leverage. But by early November, the Progressive Caucus folded and agreed to pass the infrastructure bill. Only six Democrats held the line ‘til the end (Reps. Bowman, Bush, Ocasio-Cortez, Omar, Pressley, Tlaib).

A $1.7 trillion mistake

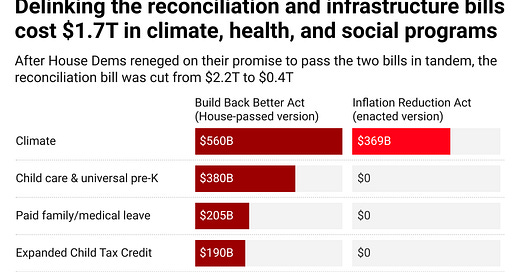

A couple weeks after the infrastructure vote, the House approved the $2.2 trillion reconciliation bill. After languishing in the Senate for nine months, the House passed a $437 billion version called the IRA. All told, delinking the two bills cost $1.718 trillion in climate, health, and other social programs.

^Alt text for screen readers: Delinking the reconciliation and infrastructure bills cost $1.7 trillion in climate, health, and social programs. After House Dems reneged on their promise to pass the two bills in tandem, the reconciliation bill was cut from $2.2 trillion to $0.4 trillion. This table compares the Build Back Better Act to the Inflation Reduction Act. Figures in billions of dollars: Climate, 560 to 369; child care and universal pre-K, 380 to 0; paid family/medical leave, 205 to 0; expanded child tax credit, 190 to 0; affordable housing, 175 to 0; medicaid home/community care, 150 to 0; ACA subsidies, 120 to 64; immigration reform, 110 to 0; education/workforce aid, 40 to 0; medicare hearing, 35 to 0; other, 190 to 4. Figures via CBO, CRFB, Joint Committee on Taxation, and Senate reports.

Thankful for this effort to resuscitate the bill:

-Stephen (@stephensemler; stephen@securityreform.org)

Find this note useful? Please consider becoming a supporter of SPRI. Unlike establishment think tanks, we rely exclusively on small donations.