Why the “DOGE dividend” polls well — and why it shouldn’t

Polygraph | Newsletter n°292 | 7 Mar 2025

*IN THIS NEWSLETTER: I break down the false promises of the “DOGE dividend” proposal gaining traction in Washington and nationwide.

*Thank you, Scott H., for becoming Polygraph’s latest paid subscriber! Join Scott and the other Polygraph VIPs if you want to support my work and gain access to exclusive content.

Situation

President Trump recently backed the idea of reimbursing the public for a portion of whatever “savings” are produced by the Department of Government Efficiency (DOGE), the quasi-government/-legal project run by unelected billionaire Elon Musk.

Here’s Trump speaking at an investment conference in February:

“[DOGE] is…saving taxpayers billions and billions of dollars every single day. And there’s even under consideration a new concept where we give 20 percent of the DOGE savings to American citizens and 20 percent goes to paying down debt, because the numbers are incredible…So many billions of dollars — it’s billions — hundreds of billions, and we’re thinking about giving 20 percent back to the American citizens.”

Here’s how Musk described the so-called “DOGE dividend” at the recent Conservative Political Action Conference (CPAC):

“It’s money that’s taken away from, from things that are destructive to the country…and from organizations that hate you, to you. That’s awesome. I mean that’s like, glorious. The spoils of battle, you know?”

Trump got the idea from Musk, who got it from a CEO of an investment firm. Per the CEO’s proposal: “President Trump has an opportunity to work with Congress to take DOGE one step further and deliver…the ‘DOGE Dividend,’ a tax refund check…funded exclusively with a portion of the total savings delivered by DOGE.”1

The idea appears to be gaining traction in Washington, and recent public polling shows that it has broad, bipartisan backing nationally. Support for the plan outweighs opposition to it by a 67% to 12% margin among all voters, 83% to 7% among Republicans, and 58% to 15% among Democrats.

The “DOGE dividend” polls well. It shouldn’t

The promise of a DOGE dividend is built on several lies and misconceptions.

1. The amount promised

The CEO claims each household would receive a $5,000 check, based on the assumption that DOGE will find $2 trillion in savings. But Musk backtracked on that promise months ago, stating he hopes to find $1 trillion in cuts. That won’t happen either. Seemingly every time DOGE announces major “savings,” it quietly retracts that announcement later on because its staff doesn’t understand government accounting. Other times, its cuts are so haphazard that the White House steps in and requests additional funding for programs that DOGE just cut.

New York Times: “[DOGE] posted an online ‘wall of receipts,’ celebrating how much it had saved by canceling federal contracts. Now the organization…has deleted all of the five biggest ‘savings’ on that original list, after The New York Times and other media outlets pointed out they were riddled with errors.”

Roll Call: “The White House is requesting Congress provide an extra $858 million in a funding stopgap bill for the FAA ‘to maintain air traffic services, hire and train air traffic controllers, and continue aviation safety oversight while avoiding critical service degradations,’…DOGE dismissed several hundred probationary employees at the agency in February…Musk later on X asked retired air traffic controllers to consider returning to work to temporarily relieve the shortage.”

AP: “Nearly 40% of the federal contracts that President Donald Trump’s administration claims to have canceled as part of its signature cost-cutting program [DOGE] aren’t expected to save the government any money, the administration’s own data shows.”

The Intercept: “[DOGE] claimed to have saved the American taxpayer nearly $232 million by canceling an IT contract for the Social Security Administration…In fact, the government cut only $560,000.”

2. The funding source

The poll question on the DOGE dividend proposal told respondents that the checks would be “funded exclusively by eliminating waste, fraud, and abuse in government spending.” That’s false. The DOGE dividend is effectively a tax cut for the rich, paid for by slashing social programs for the poor.

The GOP bill containing Trump’s legislative agenda requires the House Energy and Commerce Committee to cut $880 billion in projected spending over the next decade to finance an extension of the 2017 tax cuts and massive funding increases for the Pentagon and federal police agencies.

Because the Energy and Commerce Committee oversees both Medicaid and CHIP, many working-class voters have protested cuts to these programs. Trump and Republican leaders have reassured them that they won’t cut public healthcare, but it’s increasingly difficult to convince voters of that.

A Congressional Budget Office (CBO) report published on Wednesday reveals that Medicaid accounts for 93 percent of the funding under the committee’s jurisdiction. To meet the GOP’s spending reduction target, then, significant cuts to Medicaid are unavoidable. Even if Republicans cut every other program in the committee’s jurisdiction, they’d still fall $300 billion short. Cutting everything but Medicaid and CHIP leaves them $500 billion short. The bottom line: enacting Trump’s agenda means major reductions in public health coverage or benefits or both.

For Trump and the GOP, the “DOGE dividend” idea couldn’t have come at a better time. Republicans fear their working-class base is catching on to their true intentions, and the mythical DOGE dividend could serve as a much-needed diversion. The illusion of reaping the “spoils of battle” (as Musk put it) could mitigate the growing public backlash toward the GOP’s very unpopular plans. Among Trump voters, 71% say cutting Medicaid is unacceptable.

3. Who gets the DOGE dividend

The main reason the DOGE dividend polls so well — particularly among working-class voters — is because it sounds like a proposal for another round of the ever-popular tax rebate checks from 2020-21. But it’s not. Many working-class people support the DOGE stimulus thinking lower-income people will benefit (we won’t) and that it won’t be funded by liquidating many people’s Medicaid benefits (it will).

Neither Trump nor Musk mentioned that eligibility for the DOGE dividend is restricted to “net payers of federal income tax in CY 2025.” Most lower-income people aren’t net payers. Refundable tax credits (like the child tax credit) reduce the amount owed, leaving tens of millions of Americans owing no federal income tax. But that doesn’t mean they pay no taxes at all — most still pay state and local income and property taxes, federal taxes on things like gasoline, and payroll taxes that go to Social Security and Medicare. Still, if you’re not a net payer of federal income taxes in 2025, you won’t get a DOGE dividend check.

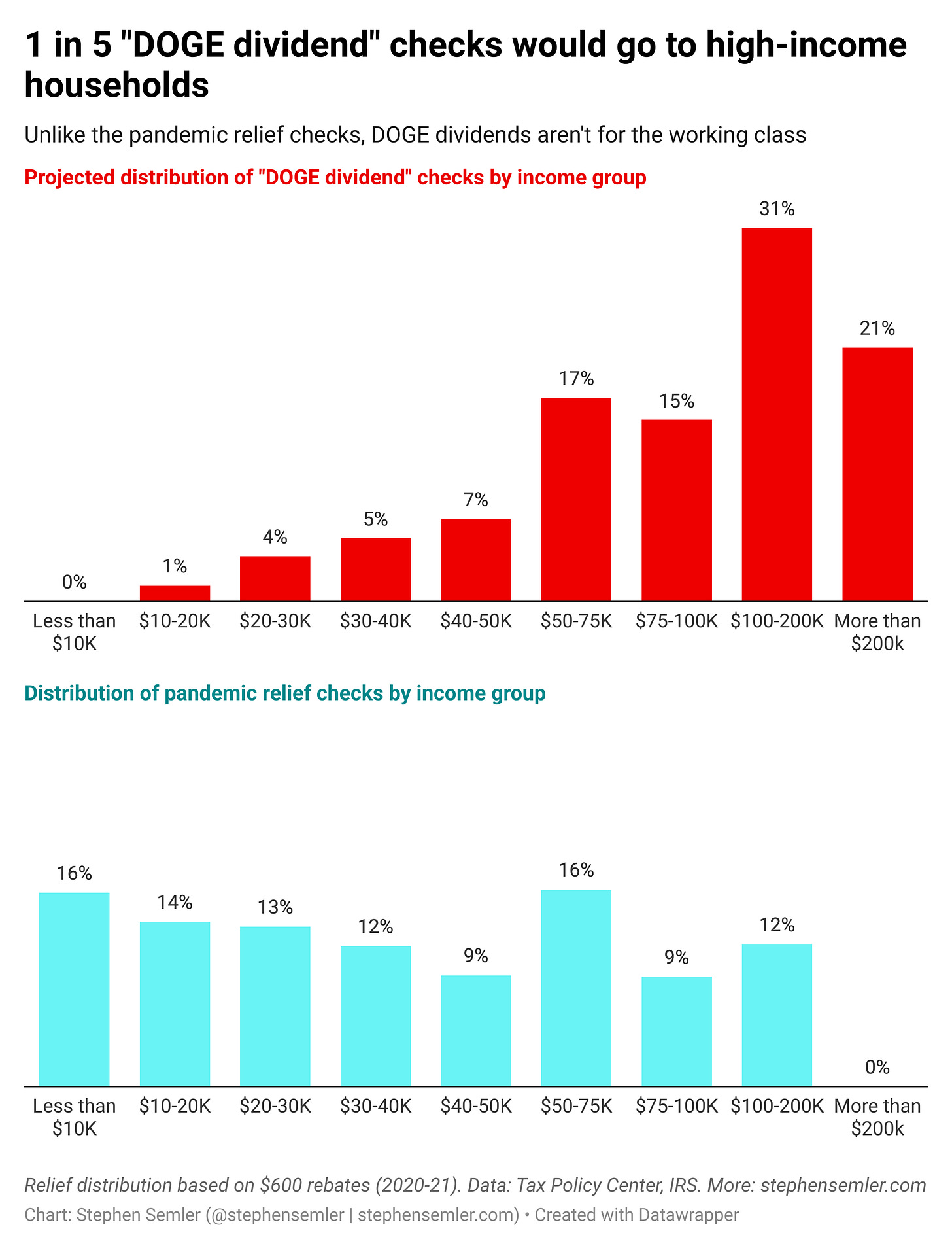

This restriction means DOGE dividend checks (regardless of their eventual dollar amount) would flow disproportionately to people with higher incomes. Billionaires like Musk and Jeff from Amazon would benefit, while tens of millions of working-class Americans who received tax rebates in 2020-21 would be excluded. Below are a few findings from my analysis comparing the projected distribution of DOGE checks to the actual distribution of pandemic relief checks.2

More DOGE dividend checks would go to people with incomes over $200,000 than to everyone earning below $50,000.

Over half of DOGE checks would go to people with incomes over $100,000.

Rounded to the nearest whole number, 0% of DOGE checks would go to people with incomes under $10,000.

This stands in stark contrast to the tax rebates issued in 2020-21:

High-income individuals (>$200,000) received 0% of the pandemic relief checks, while those with incomes under $10,000 got about a sixth.

Nearly two-thirds of the tax rebates went to people with incomes under $50,000.

Taxpayers with incomes over $100,000 received fewer than 12% of them.

^Alt text for screen readers: 1 in 5 “DOGE dividend” checks would go to high-income households. Unlike the pandemic relief checks, DOGE dividends aren’t for the working class. This chart compares the projected distribution of DOGE checks to the distribution of the pandemic relief checks by income group. DOGE checks would disproportionately go to higher-income taxpayers while the relief checks overwhelmingly went to the lower-income groups. Relief distribution based on the 2020-2021 $600 tax rebates. Data: Tax Policy Center, IRS.

The CEO’s excuse for not sending money to people who most need it is inflation — give poor people money and they’ll spend it, give it to rich people and they’ll save it. From the proposal:

“The DOGE Dividend is different from past stimulus checks (e.g. 2021 American Rescue Plan) because only tax-paying households receive it. Tax-paying households are more likely to save (not spend) a transfer payment like the DOGE Dividend as consumption is a lower share of their income.

In fact, according to a 2019 CNBC survey, 7 in 10 (71%) of Americans who unexpectedly received a $5,000 bonus would either “pay off debt,” “save it for short-term expenditures or emergencies” or “invest…in long-term goals like college or retirement.

There is nothing inflationary about paying off debt, saving for emergencies, or investing in college or retirement. In fact, debt paydowns are actually deflationary.”

Just a few problems with this:

Just because 7 in 10 said they’d do something doesn’t mean they actually would.

That survey didn’t only poll tax-paying households.3

What about high-income, high-spending households?

Nearly 8 in 10 (78%) recipients of the third round of tax rebates from the American Rescue Plan — who were largely lower-income — either “mostly saved” or “mostly paid down debt” according to the Dallas Federal Reserve:

Mostly spent: 22.5%

Mostly saved: 25.3%

Mostly paid down debt: 52.3%

If the CEO is concerned about inflation, his beef should be with corporations, not the working class.

SPECIAL THANKS TO: Abe B., Alan F., Amin, Andrew R., AT., BartB., BeepBoop, Ben, Ben C.,* Bill S., Bob N., Brett S., Byron D., Chris, Chris G., Cole H., D. Kepler, Daniel M., David J., David S.,* David V.,* David M., Elizabeth R., Errol S., Foundart, Francis M., Frank R., Gary W., Gladwyn S., Graham P., Griffin R., Hunter S., Irene B., Isaac, James H., James N., Jcowens, Jeff, Jennifer, Jennifer J., Jessica S., Jerry S., Joe R., John, John, John A., John K., John M., Jonathan S., Joseph B., Joshua R., Julia G., Katrina H., Kheng L., Lea S., Leah A., Leila CL., Linda B., Linda H., Lindsay, Lindsay S.,* Lora L., Mapraputa, Marie R., Mark L., Mary Z., Marty, Matthew H.,* Megan., Melanie B., Michael S., Mitchell P., Nick B., Noah K., Norbert H., Omar A., Omar D.,* Peter M., Phil, Philip L., Rosemary K., Sari G., Scarlet, Scott H., Silversurfer, Soh, Springseep, TBE, Teddie G., Theresa A., Themadking, Tim C., Timbuk T., Tony L., Tony T., Victor S., Wayne H., William P.

* = founding member

-Stephen (Follow me on Instagram, Twitter, and Bluesky)

The proposal uses “tax refund” but that’s not quite right, even in informal contexts. “Tax rebate” is the best term to use here, even though legislatively it’d probably be structured as an advanced payment on a refundable tax credit. The money/check itself produced by that advanced refund of a tax credit is more accurately described as a rebate than a tax refund.

Methodology: The distribution for the relief checks is based on the second-round, $600 tax rebates enacted by the Consolidated Appropriations Act of 2021. Data on the distribution of these rebates by income is available through the IRS, both in terms of the number of payments and value of payments (this study used number of payments). Here were the eligibility requirements for these $600 tax rebates, per the IRS: “The additional credit phases out at a rate of 5% of the taxpayer’s adjusted gross income (AGI) in excess of a threshold. The threshold is $150,000 in the case of a joint return, $112,500 in the case of a head of household, and $75,000 otherwise.” The projected DOGE dividend check distribution was based on the proposal’s requirement that only “net payers of federal income tax in CY 2025” would get one. A breakdown of net payers of federal income tax is from the Tax Policy Center (the proposal links to the same analysis for the same year, but broken down by quintile). The breakdown included the total number of tax units in each income bracket and the number of non-net-payers of tax units. From these data you can deduce the number of DOGE dividend-eligible households (“household” being a popular stand-in for “tax unit”) in each income bracket, then divide each bracket’s total DOGE dividend-eligible households from the overall number of DOGE-eligible households from all income brackets to calculate the projected distribution. The income brackets between the IRS and TPC were nearly identical, but a few adjustments were needed to arrive at a common income bracket list.

Thanks for pointing out that the doge dividend is timed to distract from "they won’t cut public healthcare, but it’s increasingly difficult to convince voters of that".